How Do You Calculate Unlevered Beta

How do you calculate cost of equity. Insert the formula 1 1-B6B7 in.

Unlevered Beta Formula Calculator Examples With Excel Template

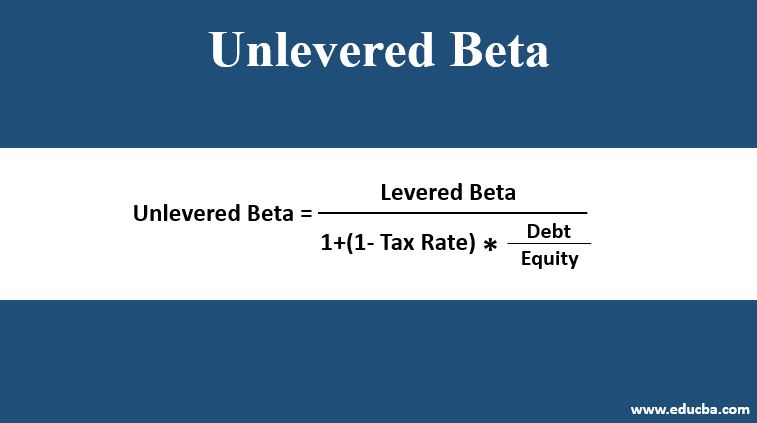

Unlevered beta asset beta Levered beta equity beta 1 1 tax rate Debt Equity textUnlevered beta asset beta frac textLevered beta equity beta.

. Unlevered Beta βCompany A Levered Beta βCompany A 11-TaxDebtEquity Unlevered Beta βCompany A 12 11-03505 091. The unlevered beta can at max be equal to the Levered beta or it can be lower that is the case when the Debt is equal to zero that is the company is completely equity financed. It is also commonly referred to as asset beta because the volatility of a company without any leverage is the result of only its assets.

Formula to calculate unlevered beta. XYZ Cos levered beta in the market is 13. Typically a companys unlevered beta can be calculated by taking the companys reported levered beta from a financial database such as Bloomberg and Yahoo Finance and then applying the formula below.

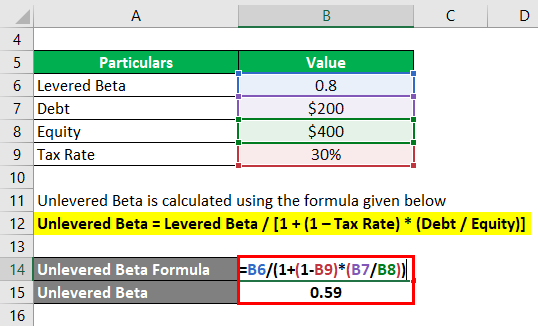

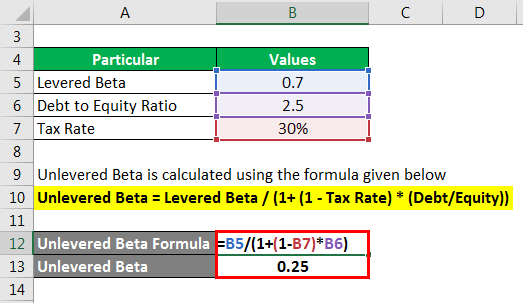

Finance in Step 1. Unlevered Beta Levered Beta 1 1 Tax Rate DebtEquity Unlevered Beta 07 1 1- 30 25 Unlevered Beta 025. The debt effect can be calculated by multiplying the debt to equity ratio with 1-tax and adding 1 to that value.

The unlevered beta removes the effects of leverage from the companys beta. Unlevered Beta Asset Beta Unlevered Beta Asset Beta is the volatility of returns for a business without considering its financial leverage. Press Enter to get the Result.

By applying the formula we find the unlevered beta value to be 091. Calculator for unlevered beta helps in making a quick calculation on entering following figures into it. Next determine the companys debt value from its balance sheet.

Unlevered Beta Beta 1 1-Tax Rate DebtEquity The last segment in the formula is the debt-to-equity ratio which shows how the standard beta is adjusted for the amount of debt the firm has. The unlevered beta is typically used in analysis alongside the levered beta to compare the risk of a stock to the market. As an example of unlevered beta lets assume you have a firm with a beta of 17 and a debt-to-equity ratio of 04.

Debt Equity ratio. Beta is the volatility of the stock versus the market and the volatility of a stock is impacted by the amount of leverage the company has. When the levered beta.

WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. To do this look up the beta for a group of comparable companies within the same industry un-lever each one take the median of the set and then re-lever it based on your companys capital structure. Firstly figure out the unlevered beta or asset beta of the company.

The formula for the levered beta can be computed by using the following steps. How Do You Calculate Unlevered Beta Asset Beta. Unlevered beta is also known as asset beta because the firms risk without debt is calculated just based on its asset.

Unlevered Beta can be calculated using the following formula Beta Unlevered Beta levered 1 1-tax DebtEquity As an example let us find out the Unlevered Beta for MakeMyTrip. For XYZ Co the tax rate is also 35 since it has a larger size. Tc is the average corporate tax rate that you computed in Step 2.

Insert the formula B4B5 in cell B7 to calculate the debt-equity ratio. Calculation of the firms risk premium is done by multiplying the companys unlevered beta with the market risk premium. Asset Beta is the beta of a company without the impact of debt.

The unlevered beta of listed companies is available at many stock market databases. And DE is the debt-to-equity ratio you calculated in Step 3. It compares the risk of an unlevered company to the risk of the market.

Formula for Unlevered Beta Unlevered beta or asset beta can be found by removing the debt effect from the levered beta. Δ S i α β i Δ M e where. Levered Beta Formula in Excel with Template Step 1.

For calculating Unlevered Beta take the below stated formula into account. Popular Course in this category. βL βU 1 1 - tde Where.

Bl 1 1-Tcx DE. Unlevered Beta β a 13 100 million 100 million 20 million 1. βL the firms beta with leverage 15 βU the firms beta with no leverage t the corporate tax rate 40 de the firms debtequity ratio 3565.

Δ S i change in price of stock i α intercept value of the regression β i beta of the i stock return Δ M change in the market price e residual. Calculate the companys unlevered beta according to the following formula. To determine the risk of a company without debt we need to un-lever the beta ie remove the debt impact.

Unlevered beta is calculated as. Therefore XYZ Cos unlevered beta will be as follows. Unlevered beta aka.

In this formula Bl is the levered beta that you pulled from Yahoo. Unlevered beta Levered beta 1 1 -. Dividing levered beta with this debt effect will give you unlevered beta.

Unlevered Beta Levered Beta 1 1 Tax Rate Debt Equity About the Calculator Features. Unlevered beta is known as asset beta while the levered beta is known as equity beta. To calculate unlevered beta the formula divides the levered beta by 1 plus the product of 1 minus the tax rate and the companys debtequity ratio.

It only takes into account its assets. Just like with the levered beta the baseline is 1. We first need to calculate the debt-equity ratio.

Therefore its debt-to-equity ratio is 20.

Unlevered Beta Explanation Examples With Excel Template

Unlevered Beta Explanation Examples With Excel Template

Unlevered Beta Formula Calculator Examples With Excel Template

0 Response to "How Do You Calculate Unlevered Beta"

Post a Comment